The venture capital model is trapped in a death spiral of its own making. ⚠️

The data tells a stark story: for 2020-2022 vintage funds, top quartile IRRs range from a mediocre 0% to 14.7%, with 2021 funds posting a dismal 4.4% median IRR. Compare this to the historical early-stage venture average of 19.7%, and the magnitude of underperformance becomes clear. 📉

The total value to paid-in capital (TVPI)1 for AngelList hosted funds has flatlined.

The data tells us that funds are sitting on hefty paper markups without seeing enough exits to return even half of what LPs initially put in.23

What happened? Three converging forces created a perfect storm: 🌪️

Capital Oversaturation 💰💰💰: Unprecedented amounts of capital flooded into venture during 2020-2021, yet as per Pitchbook the number of truly exceptional companies has gone down. This created a fundamental supply-demand imbalance.👇

Interest Rate Shock ⚡📈: When rates spiked in 2022-2023, the decade-long assumption of cheap capital evaporated. Companies valued on growth rather than profitability suddenly found themselves in hostile territory. Over 20% of all priced US rounds on Carta this year have been down rounds. 🚨

Exit Pathway Collapse 🚪🔒: The M&A market—the primary exit route for most venture-backed companies—contracted severely. Public markets began scrutinizing acquisitions for immediate profitability rather than future potential, dramatically reducing exit multiples.

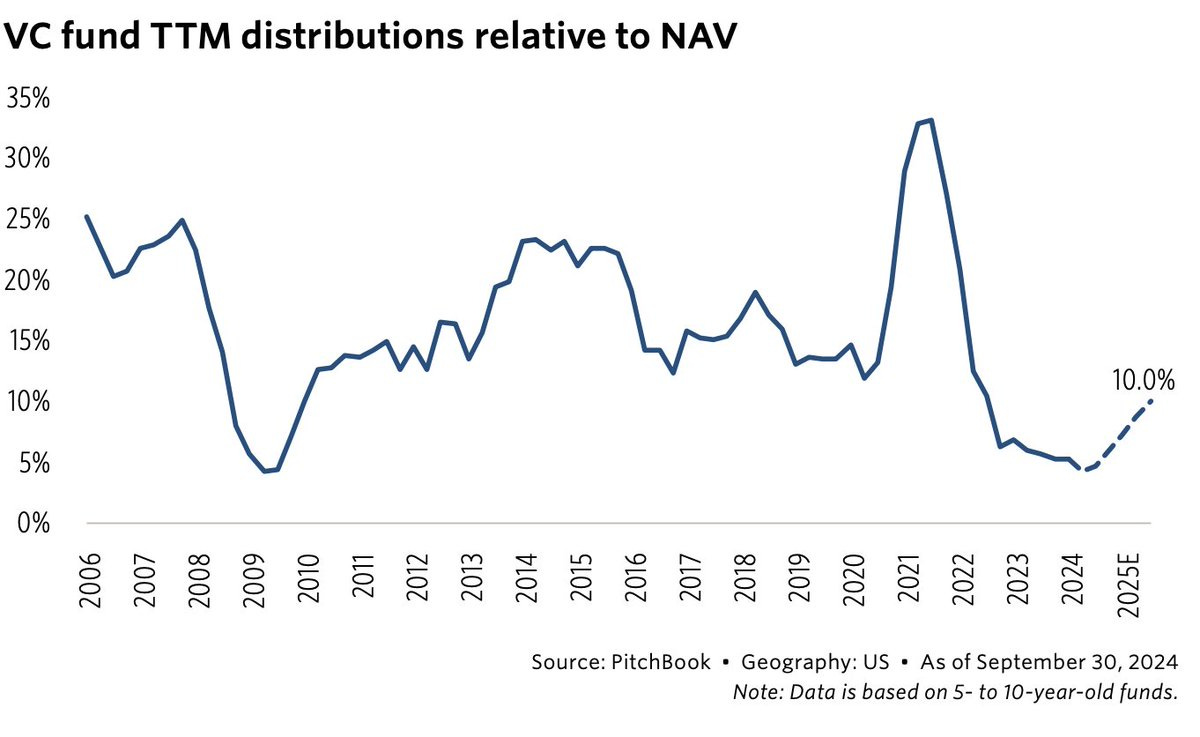

The numbers are sobering. According to Carta's 2024 data, graduation rates from seed to Series A are declining precipitously. More alarmingly, less than 10% of 2021 funds have reported any distributions to LPs after three years—a liquidity desert unprecedented in modern venture capital. 🏜️

Down rounds have skyrocketed but even these mark-downs mask the truth: there's a widening gulf between private valuations and what acquirers are willing to pay. For the first time in decades, the trendline of exit values has decisively broken from its historical upward trajectory.

Exit multiples for growth software companies and rule-of-404 firms remain stubbornly low, creating a dire situation for the VC asset class, as all ROI relies on long-tail M&A outcomes that are increasingly elusive. 🎯

The implications are severe: ⚠️

Many venture funds will simply cease to exist. Carta data confirms 2,725 VC funds disappeared in 2023 alone. ☠️

Limited partners will reduce allocations to venture capital as an asset class. 📉

Thousands of "orphaned" startups with unsustainable burn rates and unrealistic valuations will face extinction. 🦖

Even "successful" companies will exit at multiples that don't support their last private valuation. 📌

This isn't a temporary correction—it's a structural reset. 🔄

The venture model optimized for a world that no longer exists: one where capital was cheap, talent was the primary constraint, and growth could substitute for profitability indefinitely. Today's reality demands a fundamentally different approach to company building. 🏗️

In the next ZeroVC article, we'll explain how AI changes the venture game. 🤖

Stay tuned and drop us a note at hi@zerovc.xyz

TVPI (Total Value to Paid-In Capital): The ratio of the current value of investments plus distributions to total capital invested.

DPI (Distributions to Paid-In Capital): The ratio of money returned to investors relative to money invested; measures actual realized returns.

Vintage Year: The year in which a fund begins making investments, used to benchmark performance against peers.

Rule of 40: A principle stating that a software company's combined growth rate and profit margin should exceed 40%.

Sources: Carta, Pitchbook, AngelList, and https://x.com/carrynointerest